Hi everyone, thanks for dropping by the blog. In this article, I discuss the importance of building a portfolio of income-producing assets (Stream Stack) during the earlier years of your career and how such a portfolio can look. I often get asked why the early years? I recommend the early years because this is the time you are likely most motivated to work extra and take call shifts. Much like a 401k, the longer you compound equity in real estate assets, the more substantial your passive income portfolio will be when you decide to use the cash flow.

If you intentionally take action, you can construct a self-funding deal machine in as little as 5-7 years. Doing this early and often in one’s career can generate a snowball effect where early investments start feeding equity into future investments. Over time, this can result in an extensive portfolio of income-producing, tax-advantaged cash flows that allow you options to win back your time.

What is a Stream Stack?

A Stream Stack is a strategy that builds a portfolio of income-producing assets to diversify your wealth and provide passive tax-advantaged income not related to employment.

Building a Stream Stack

When investing in real estate, either passively or actively, we often focus on cash flow and cash-on-cash (CoC) returns, and rightfully so. We all desire to build a portfolio of assets that produce enough cash flow to pay for the lifestyle we choose to live. However, unless you have a few million dollars to put to work initially, it will take time to build this cash flow machine. While working in your career, instead of focusing on cash flow immediately, I like to focus on growing the amount of equity I have invested into deals. The cash flow you receive from these investments is a return on equity. This article will discuss building a Stream Stack over the next 5-7 years while working in your profession and eventually reaching a point where new investments are funded almost entirely by past investments.

The Vision

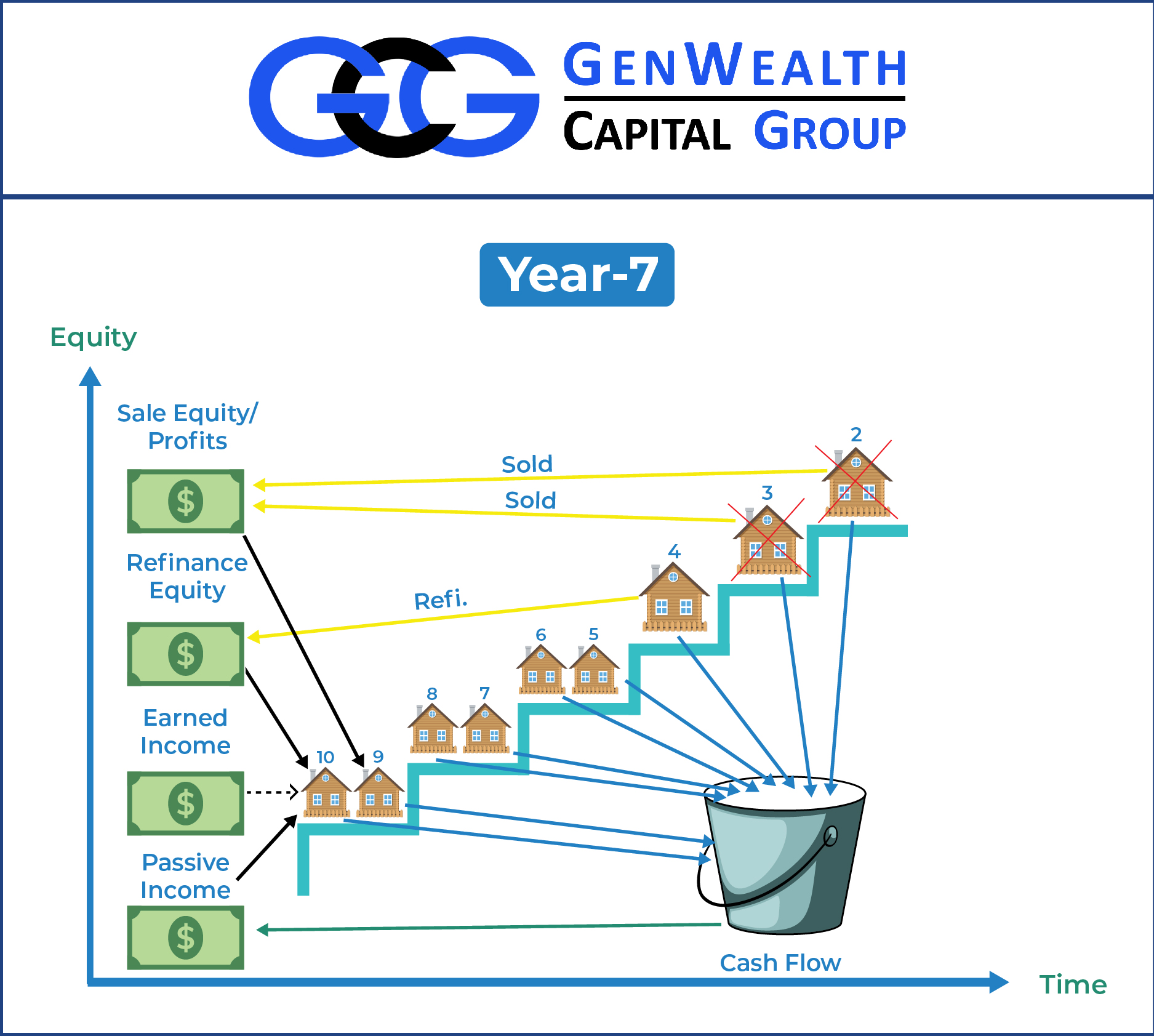

I imagine all owned assets as riding on an escalator. The climbing escalator represents equity growth from natural and forced appreciation and tenant debt pay-down. As you accumulate more assets, early investments move up the escalator, and recent ones start on the first step. Cash flow from investments goes into a bucket and is combined with earned income from employment to fund future acquisitions. When an asset is refinanced or sold, returned equity and profits are used to purchase additional assets that start at the bottom of the escalator.

The Stream Stack Pathway

Healthcare professionals must learn many pathways in their respective schooling: pain pathways, coagulation cascades, and countless others. I, therefore, like to present the theory of asset accumulation as a pathway.

The scenario in the paragraphs to follow is entirely fiction and can significantly vary depending on initial capital, frequency of and return on investment, and timing of dispositions (sales). I purposely omit projected returns to focus on tracking capital flows in and out of assets during the income stream stacking process.

Year 1 : You use your earned (employment) income to purchase your first buy and hold real estate investment. Congrats, you now have an asset on the bottom of the escalator. For the sake of this discussion, we will assume all purchases are multifamily value add deals. However, asset stacking can also be achieved with personally owned properties and different asset classes within the syndication space. The yearly cash flow goes into a bucket to purchase your next deal.

Year 2: You use earned and passive income to fund deal 2. Deal 1 moves up the escalator, while cash flow goes to the bucket for the next purchase.

Year 3: You experience your first liquidity event with the refinance of asset number 1. Deal 3 is funded with the returned equity from the refinance and earned and passive income.

Year 4: Deal 4 is funded with earned and passive income.

Year 5: Asset 1 is sold, and asset 2 is refinanced, returning significant equity and profits. Investments 5 and 6 are purchased with these proceeds and passive and earned income.

Year 6: Investments 7 and 8 are purchased using earned and passive income. Asset 1 has dropped off due to last years sale.

Year 7: The sale of assets 2 and 3 and refinance of 4, along with increased passive income fund deals 9 and 10. Minimal earned income is used to fund future investments.

The portfolio grows and along the way experiences liquidity events such as refinances and asset sales. This capital is quickly put to work purchasing additional assets. As the deals stack, the cash flow bucket grows larger. Over time, less and less earned income (represented by the year seven broken arrow) from your job is needed to fund future acquisitions. Imagine this process over 15 years, investing several times per year with capital generated entirely from the portfolio! Eventually, your Stream Stack could produce enough passive, tax-advantaged cash flow to support part or all of your lifestyle, which can open up options that you never imagined possible! What does it take, you ask? Education, networking, and consistent action! I am here to help. Feel free to reach out if you’d like to talk about how you can build a Stream Stack.