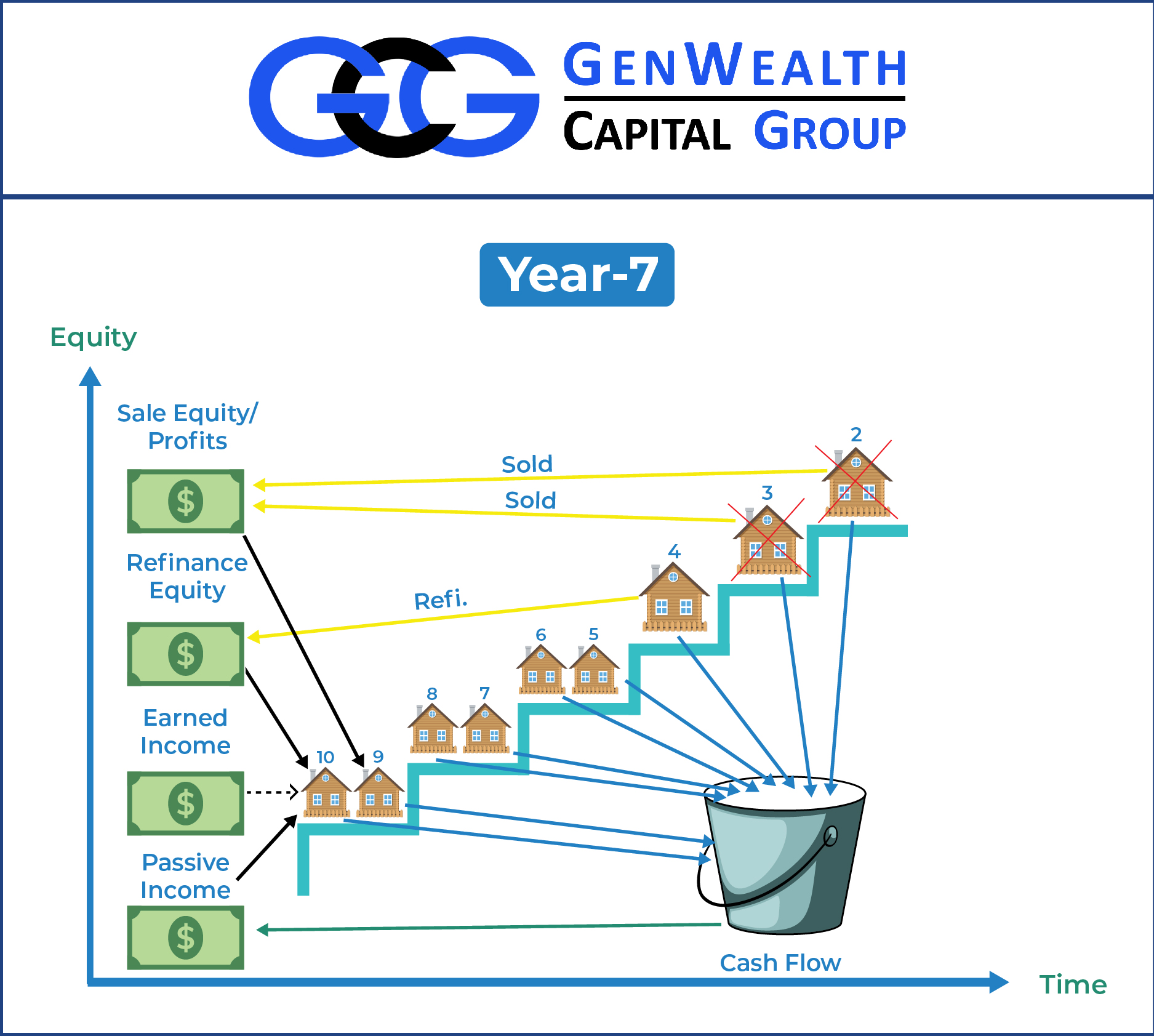

Tax Strategies For Real Estate Investors

With the “joy” of tax season exiting the rearview mirror, it is a great time to consider how real estate investors can optimize their tax strategy for the upcoming year. Taxes aren’t the most exciting aspect of real estate investing, but they’re essential to understand. As a real estate investor, it’s more fun to focus … Read more