Well as with most things in life, it’s not that easy of an answer. Interest rates are just one variable that effect multifamily valuations and the relationship is definitely not 1:1.

To begin with the historical rate spread between apartment cap rates and the 10 year treasury is approximately 2%, or 200 basis points (bps). However, the spread has fluctuated during different economic conditions, ranging from 0% during the financial crisis to over 3% as recently as 2020.

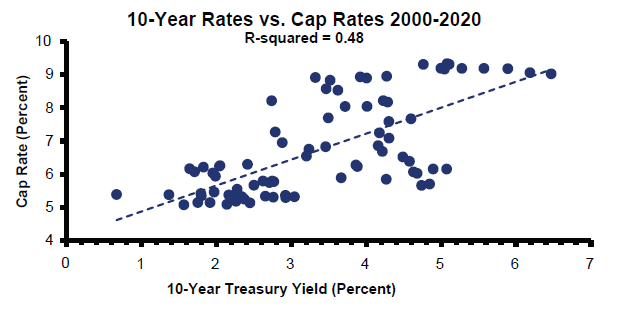

The rate spread should be thought of as the risk premium investors are demanding for real estate investments. Spreads themselves expand or shrink over time based on the different risk perceptions. If interest rates are rising this may not mean cap rates will also rise if the asset class remains in favor due to high growth expectations or a better relative risk profile. In fact, the Fed hiked 9 times between 2015-2019 and as the figure below shows, cap rates continued to decrease.

Figure 3 demonstrates the various risk premiums demanded by debt and equity holders. The figure is for all commercial real estate, not just multifamily, but again demonstrates changing relationships over time.

So although cap rates and interest rates generally follow a similar trend, the relationship is one of correlation, not causation. Think of the famous study showing a relationship between US ice cream sales and pool drownings. The two variables show a strong relationship but clearly hot summer temperatures is the driver, not bloated swimmers. In fact, Dr. Peter Linneman studied the rate spread relationship and statistically demonstrated that cap rates are not driven by either real or nominal interest rates. Instead, the driving factor is the flow of funds into commercial real estate which he expressed as increase in mortgage debt as a percent of GDP.

This is why savvy multifamily investors continue to be bullish in the near and medium term. We are experiencing record apartment absorption, inflation is pushing rent revenue, lenders have reloaded for 2022, and additional capital continues to enter the space. Although interest rates are likely to increase in 2022 and will pressure interest rate payments, numerous other factors continue to support multifamily pricing trends.